Home » Burial Insurance » Burial Insurance in Indiana

Burial Insurance Plans in Indiana

Planning ahead isn’t just practical—it’s one of the most thoughtful gifts you can leave your loved ones. In Indiana, funeral and burial costs continue to rise, often leaving families facing emotional stress along with significant financial challenges.

Burial insurance—sometimes called final expense insurance—offers a simple, affordable solution. It helps cover essential end-of-life expenses, so your family doesn’t have to worry about finances while grieving.

Why Burial Insurance Matters in Indiana

The cost of funerals in Indiana can vary depending on tradition, services chosen, and provider. Typical expenses include:

- Funeral service or memorial ceremony

- Casket, urn, or cremation package

- Burial plot, niche, or headstone

- Transportation, permits, and administrative fees

- Flowers, obituary notices, and reception gatherings

What Is Burial Insurance?

- Funeral or cremation costs

- Small medical bills or unpaid household expenses

- Settling minor debts

- Carrying out personal wishes (such as donations or memorials)

Customized Burial Insurance in Indiana

- Local funeral home costs in Indiana

- Religious or cultural practices in Indiana

- Preferences for cremation or traditional burial in Indiana

- Average end-of-life expenses specific to Indiana

Who Should Consider Burial Insurance in Indiana?

- Seniors and retirees wanting peace of mind

- Individuals without large life insurance coverage

- Adults with medical conditions who need simplified approval

- Families planning responsibly for unavoidable expenses

Key Benefits for Indiana Residents

- No medical exams for most applicants

- Affordable, locked-in premiums

- Affordable, locked-in premiums

- Flexible use of funds (funeral, cremation, or bills)

- Fast approval process, often within days

How the Process Works in Indiana

- Request a personalized quote from a licensed agent in Indiana

- Answer a few basic health questions—no medical exam required

- Choose a coverage amount that matches your needs and budget

- Review and receive your policy documents

- Your chosen beneficiary receives the payout when the time comes

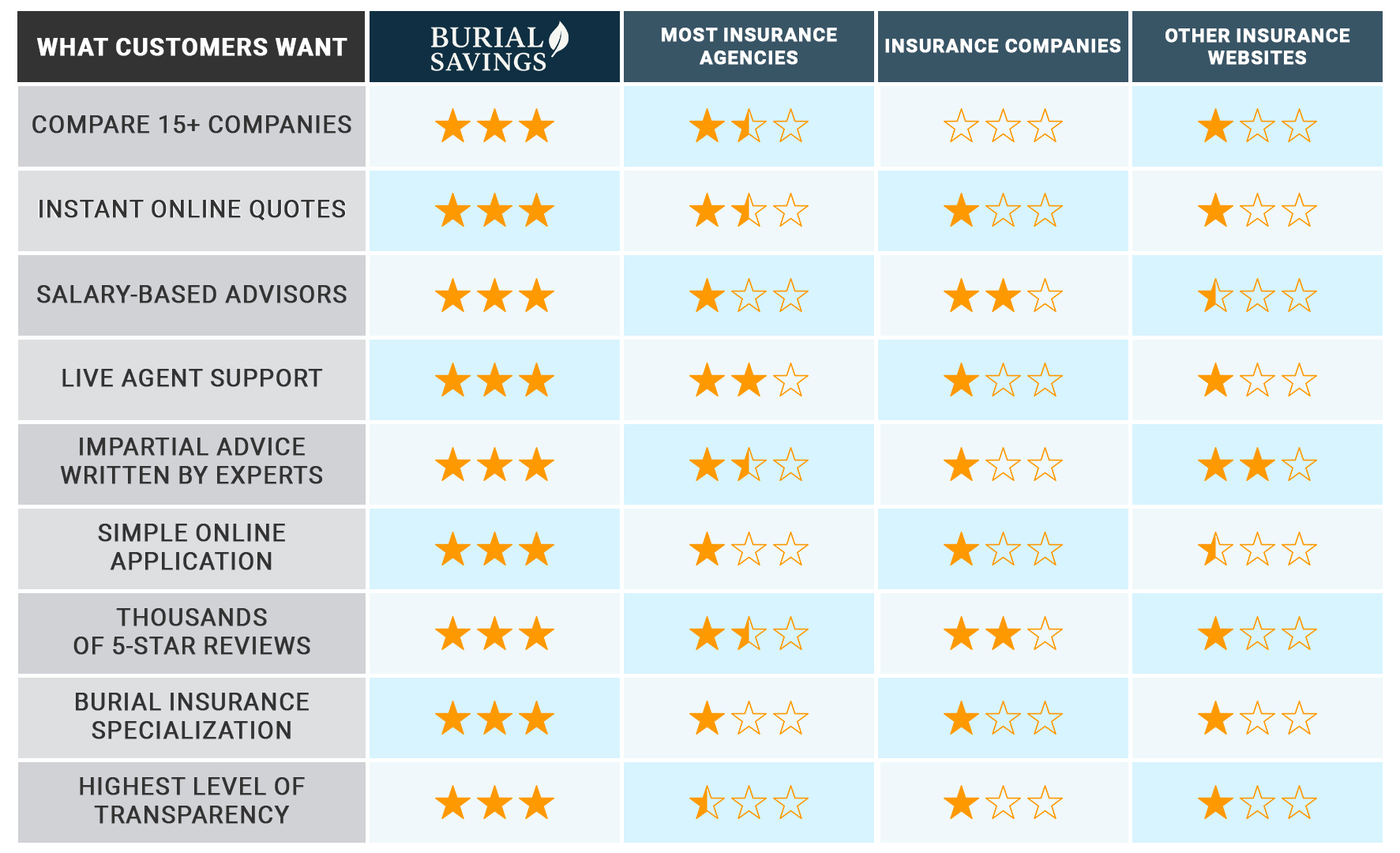

Choosing the Right Provider in Indiana

- The insurer’s financial strength and customer ratings

- Clear policy terms without hidden exclusions

- Local knowledge of funeral costs and customs in Indiana

- Access to licensed agents who serve families in Indiana

Frequently Asked Questions – Burial Insurance in Indiana

Absolutely. While many buyers are seniors, adults in Indiana often purchase burial insurance early to secure lower premiums.